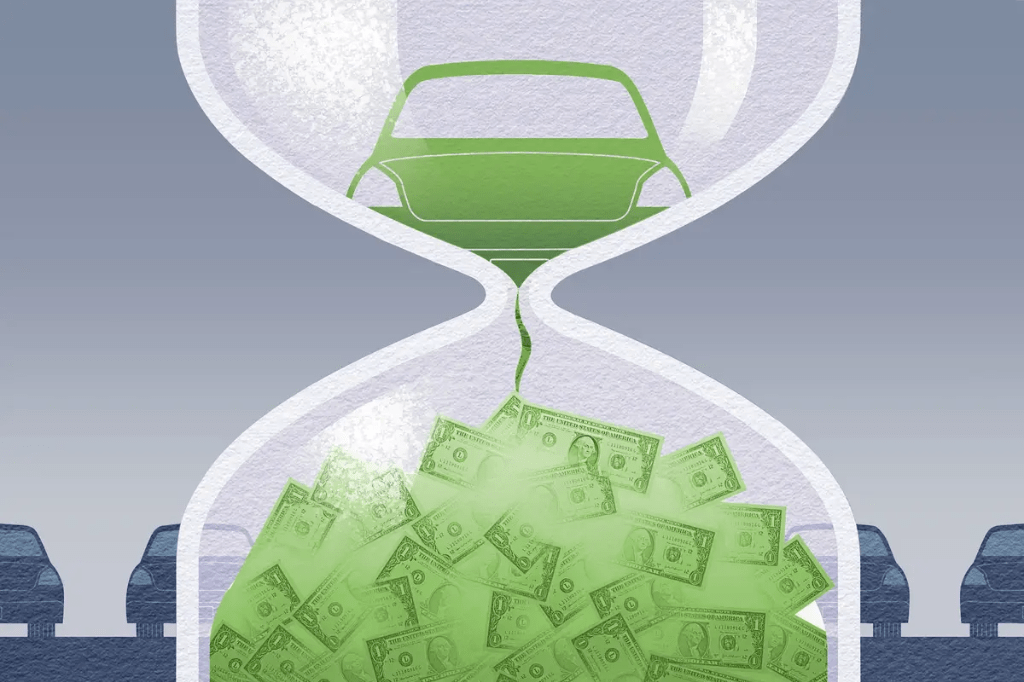

Are you thinking about buying a new car, but you still owe on your current one? You’re certainly not alone—and the good news is: you can trade in a financed vehicle. But before you visit a dealer, there are some important financial and logistical considerations to take into account.

In this blog, we’ll clarify how trading in a financed car works, what you should expect during the transaction, and how to make the smartest financial move possible.

What Does It Mean to Trade in a Financed Car?

A financed vehicle means that you are still paying a car loan to purchase that vehicle. So when you trade in the car, you are technically selling the vehicle to the dealership—but instead of going home with cash, the equity of your financed vehicle will go towards:

- Paying off the remaining balance of your loan

- Planning your future vehicle purchase (if there is equity)

Ultimately, whether this process works for you or against you, will depend on how much you owe, versus how much your car is actually worth.

Key Terms You Should Know

- Payoff Amount – This is the total amount you owe your lender (including interest or fees).

- Trade-In Value – How much a dealership is willing to pay for your car based on its age, condition, mileage, and market demand.

- Equity – Equity is the difference between the trade-in value of your car and the balance of your loan:

- Positive Equity = Your car is worth more than you owe.

- Negative Equity (or “upside-down loan”) = You owe more than your car is worth.

How Does the Trade-In Process Work?

Step 1. Identify How Much You Owe

Call your lender and find out the payoff amount on your loan.

Step 2. Identify Car Trade-in Value

Use websites like Kelley Blue Book or Edmunds, and call several dealerships & get quotes on your vehicle.

Step 3. Compare the numbers

- If your car is worth more than you owe → the difference will go to your next car purchase.

- If your car is worth less than you owe → you will pay that difference upfront or include it into a new loan.

Step 4: Take your Vehicle to the Dealership

The dealership will assess your car, provide a trade-in valuation, and deal with the loan payoff with your lender.

Example Scenarios

Scenario 1: Positive Equity

- Trade-in value: $10,000

- You owe: $8,000

- Result: You will have $2,000 towards the purchase of a new car.

Scenario 2: Negative Equity

- You owe: $15,000

- Trade-in value: $12,000

- Result: You will still owe $3,000 which MUST be:

Paid upfront, or Rolled into your next car loan (increased repayment).

Things to Watch Out For

- Owing Negative Equity – This just adds debt to your next vehicle and leads to a cycle of always being “upside-down” on your loans.

- Trade In Value – Dealerships may offer less than the fair value in a private sale. Look around to find the best deal for you.

- Loan Length – If you owe negative equity and you roll it over, be careful not to stretch the next loan over a long term and also end up with a lot of interest.

- Fees and Early Payoff Penalty – Make sure to check if your lender has an early payoff fee before you trade in.

Tips to Make the Smartest Trade-In Decision

- Know your numbers: Have the exact figures for your payoff and car value.

- Shop around: Get multiple trade in offers to consider.

- Increase your equity: If you are close to paying off your loan, wait until you have built some positive equity.

- Think about going private: You might receive more than you would if you traded it in by going through a dealer.

- Negotiate your next deal: Don’t just focus on what your monthly payments; look at the total cost of the loan instead.

What Documents Do You Need?

When you trade in your financed car, it is important that you bring the following documents:

- Your drivers license

- Your vehicle registration

- Proof of insurance

- Your loan payoff information

- Any of the extra keys or manuals that came with the vehicle.

The dealer will contact your lender directly, handle the loan transfer, and pay the loan off.’

Conclusion

Yes, you can definitely trade a financed car even if you’ve not finished paying it off. Just keep in mind how much equity you have (positive or negative), and how you plan on financing your next vehicle purchase. If you do it right, trading in can be a seamless way to transition to a new vehicle, just plan the process and do the math so you’re not rolling an impending debt into a longer-term loan.

If you are still unsure about trading or if you should wait, talk to a financial adviser or a dealership finance expert to help you decide what is best for your lifestyle and budget.

Read about: How to Get Seo Clients?

Leave a comment